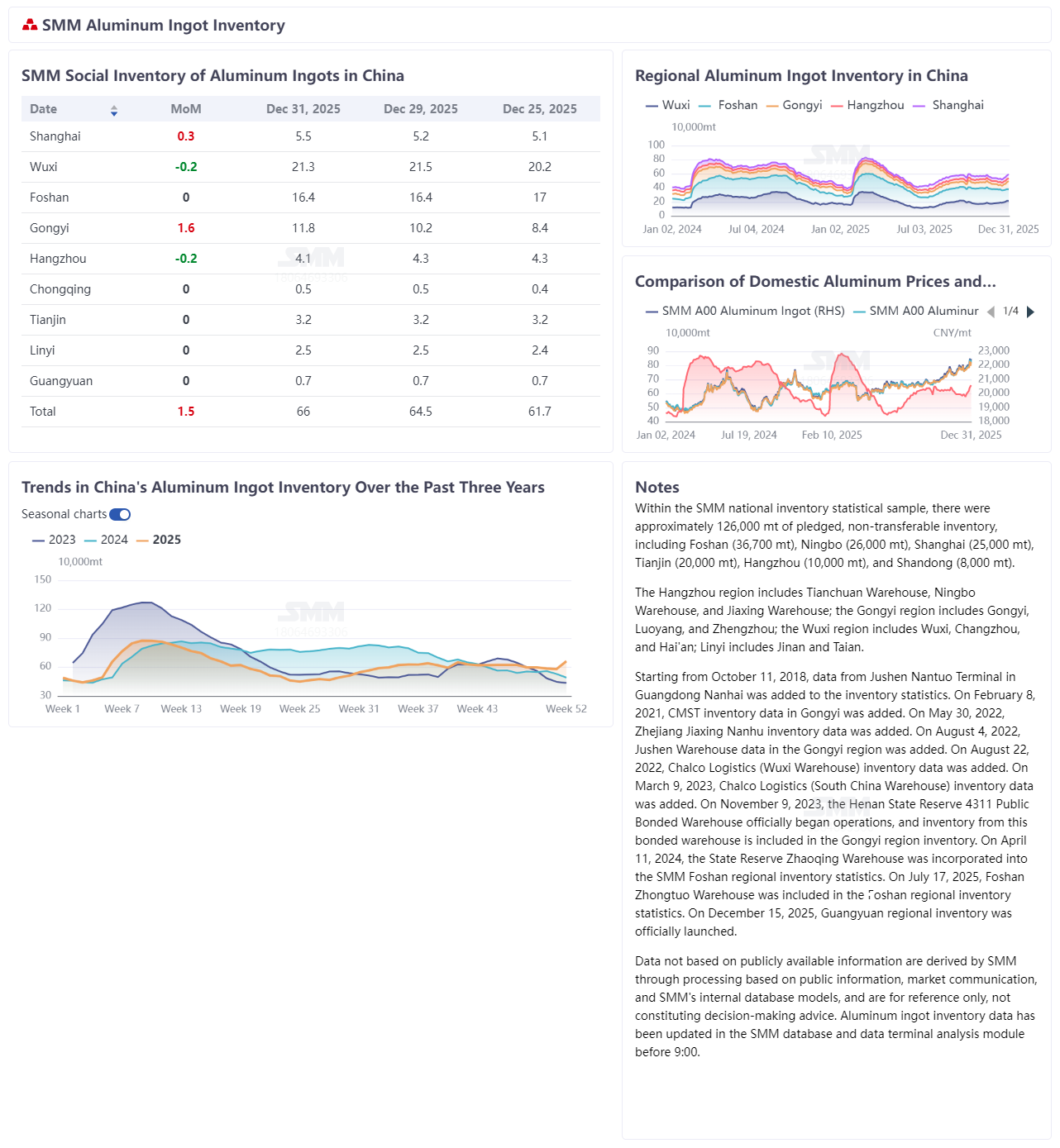

With the much-discussed issue of Xinjiang's shipping backlog coming to an end, domestic aluminum ingot inventories began to build up from mid-December, successively breaking through the 600,000 mt and 650,000 mt thresholds. By the end of December, inventory levels had increased by nearly 15% compared to the levels on December 18. Of course, the reasons for this sustained inventory buildup cannot be attributed solely to the recovery in shipping. Considering the core context of Xinjiang's shipping resumption, the current domestic aluminum ingot inventory buildup is primarily due to a combination of four factors: "increased supply arrivals + weak demand digestion + industrial structural adjustments + high aluminum prices suppressing consumption." SMM has summarized the four main reasons for the year-end shift in domestic aluminum ingot inventory trends for your reference:

1. Resumption of Xinjiang Shipping Leads to Concentrated Arrivals of Backlogged Goods

After resolving the bottleneck that previously constrained aluminum ingot circulation, the previously delayed aluminum ingots were shipped and arrived in bulk, directly driving a short-term increase in inventory. Data shows that after Xinjiang's shipping became smooth, although there were fluctuations in the volume of goods en route to key consumption areas such as Wuxi and Gongyi, the overall level remained high. The effect of concentrated arrivals was particularly evident from the previous weekend to the beginning of this week, becoming the direct trigger for the phased inventory buildup. Additionally, with the return to normal rail transportation efficiency following the shipping resumption, the previously used trucking channels, which were less economical, were phased out, further confirming the normalization of aluminum ingot delivery rhythms and providing a logistical foundation for inventory accumulation.

2. Increased Supply Capacity and Casting Volumes Amplify Inventory Pressure

(1) Continuous Commissioning of New Capacities: Ongoing ramp-up of new domestic electrolytic aluminum projects, including the electrification of new projects in Inner Mongolia and the commissioning of some idle capacities in Xinjiang, have steadily increased operating aluminum capacity. In December, domestic aluminum production was up 1.9% YoY and 4.0% MoM, with daily average production continuously rising, providing incremental support to aluminum ingot supply.

(2) Increase in Casting Volumes: Overall downstream operating rates declined in the month, with the proportion of liquid aluminum also decreasing, down 0.8 percentage points to 76.5% compared to the previous month, exceeding initial expectations. The main reasons include: first, the impact of the traditional off-season was more pronounced than expected; second, high aluminum prices put further pressure on downstream profits; third, environmental protection-driven production restrictions in some regions intensified, exceeding initial expectations. According to SMM data on the proportion of liquid aluminum, domestic electrolytic aluminum casting volumes in December decreased 13.4% YoY but increased 7.7% MoM, directly increasing the supply of aluminum ingot inventory. It is expected that the proportion of liquid aluminum will further decrease to 75.1% in January 2026, with the trend of increasing casting volumes continuing to exert pressure on inventory.

3. Weak Downstream Demand During the Traditional Off-Season and Severely Insufficient Inventory Digestion Capacity

(1) Traditional Off-Season + High Prices Suppress Demand: Currently in the traditional off-season for aluminum consumption, coupled with aluminum prices fluctuating at highs putting downstream enterprises under profit pressure, purchase willingness remains sluggish, and cargo pick-up demand has been significantly suppressed. This week, the operating rate of leading aluminum downstream processing enterprises fell 1 percentage point WoW to 59.9%.

(2) Environmental Protection-Driven Production Restrictions Exacerbate Demand Contraction: Environmental protection-related controls continue to intensify in core consumption areas such as central China, leading to full production halts at some aluminum processing enterprises and a direct contraction in spot aluminum demand. The pace of inventory digestion slowed substantially, with Gongyi region’s inventory nearly doubling in less than half a month. Moreover, demand recovery will need to wait until after the New Year holiday to observe whether environmental protection controls can be relaxed. In the short term, inventory reduction still lacks momentum.

4. Imbalanced Regional Inventory Distribution and Obstacles in Warehouse Withdrawals Aggravate Inventory Buildup Trend

Warehouse areas such as Gongyi are already experiencing noticeable inventory buildup pressure due to downstream production cuts and weak cargo pick-up. Although large discounts may help divert aluminum ingots to Wuxi, short-term regional inventory digestion faces time lags. At the same time, high aluminum prices have weakened restocking willingness among buyers, further limiting inventory turnover efficiency. Additionally, expectations of a continuous increase in casting ingot volume before the Chinese New Year suggest the inventory accumulation trend will persist.

In summary, as the year-end approaches, disruptions in aluminum ingot shipments are gradually subsiding, while supply-side pressure is expected to become more pronounced in Q1 2026. On the demand side, weakness persists. In Gongyi, continued tightening of environmental protection-related controls has significantly slowed the pace of aluminum ingot warehouse withdrawals. Combined with the dampening effect of high aluminum prices on downstream purchase willingness, demand-side stability lacks effective support.

Considering the triple factors of high aluminum prices restraining warehouse withdrawals, sustained smooth shipments from north-west China, and a steady increase in casting ingot volume before the Chinese New Year, the overall inventory buildup trend for domestic aluminum ingots in Q1 2026 appears inevitable. SMM expects domestic aluminum ingot inventory to continue a pattern of slight increases in early January, likely fluctuating within the range of 650,000–750,000 mt. The probability of inventory breaking through the 700,000 mt mark in the second half of January rises significantly, with end-January inventory projected to reach around 730,000 mt. From a fundamental perspective, negative feedback from the inventory side is expected to somewhat restrain the momentum for aluminum price surges after the New Year holiday.